I just wanted to share some MACRO charts that have my attention during the next week or two. Let's start with the stock/bond ratio.

Stock/Bond Ratio

The possible head and shoulders top pattern was negated last week. Thats pretty damn bullish for the ratio. There is a trend-line that connects the two previous tops (not shown) that adds significance to the ~1.45 resistance zone.

We also must note the RSI divergence. RSI is not really jiving with what price is telling us. However, we must also note RSI has lacked significance across the board in this rally.

As we can see at this major trend-line confluence a bottom formed at the ratio ripped higher. This

With more concerns being voiced about an overextended market I figured I'd share a few charts that tell me when I'll be more concerned about a top. A short term peak does appear within reach based on some of these charts.

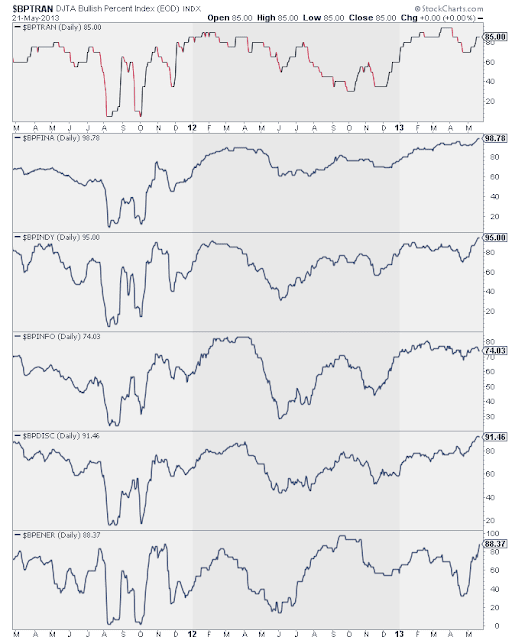

Indicators

The NYSE bull % ratio is approaching what has been major resistance so far in this rally. It make sense if we turn lower after touching this line.

The 10 day MA of TRIN is not showing any signs of a significant top yet.

However, the 10 day EMA is getting very close to resistance.

The CPCE is also showing we are near a potential short term top. This could offer a gauge of how significant the top will be.

We are still seeing normal action in Volatility as we approach a bearish boundary. We can see each time this indicator has reached the upper boundary in this rally, it has followed up with a test of the lower boundary area.

So again we may be nearing a short term top. However, the one indicator that hasn't fibbed to us once in this entire market rally, is still not telling us to be concerned about a larger top.

International

Shanghai has long lagged the market, but the rising tide lifts all boats theme may be in play here as this could be putting in a major long term bottom.

Spain is sitting just under major resistance. This line is a head and shoulders bottom neckline. Whatever the direction the IBEX is worth noting this week.

Dividends & Safe Havens

Dividends & Safe Havens

The Dow Jones Electricity index had traded inside this rising channel basically since the 09' lows. In April we popped over it. Now we are falling back into the channel with a potential monthly engulfing candle. Often that's a sign of trend exhaustion. We'll know more mid-summer, but I wouldn't be long the space with your money.

While electric utilites may have seen upside capitulation, Staples haven't are still trading at the highs. The recent higher volume is something to be aware of.

This ratio displaying pharma relative strength broke out a month ago, but off the last market bounce Pharma stocks have really lagged. A test of the lower boundary line would make sense at this point.

Commodities

Possible bullish head and shoulders forming just over the long term moving averages. Also note the increase in volume the last few week. This is just something to keep in mind when thinking about some retail positions.

Tin has formed a long term higher low. Is this another bullish head and shoulders? Given the talk about the commodities being doomed this is kind of impressive.