Studying wave theory and watching CNBC got me all sorts of bearish yesterday (bahaha), so let's take a look at the bears' technical take. There are plenty of classic arguments to make and I've added reasonable bullish counters where applicable.

Bulls EVERYWHERE: Yesterday on CNBC seemingly every commentator says the government shutdown / debt ceiling is a buying opportunity. We know they are buying as every little dip has been bought. While veteran traders have been making tactical trades around news flow, late bulls are convinced the dips are their golden opportunity to finally get long the markets.

Bullish Counter: Hedge funds have been wrong all year and are

more bearish than they've been all year.

Diverging breadth and leadership: Tom McClellan had an

excellent piece last week on the significant divergence in new highs. That said, we still have a solid amount of new highs being made. Maybe it's enough to keep that market going?

Moderate divergences are appearing in the transports, financials and consumer discretionary. Tech appears to be so strong it may make a new relative high.

Similar deterioration is shown in the S&P 500 % of stocks above the 50 + 200 day SMA. Also note the deterioration in the % of stocks on a PnF buy signal.

Bullish Counter: Divergences are a fool's game here, The S&P 500 just broke out of one of the largest bases in it's history.

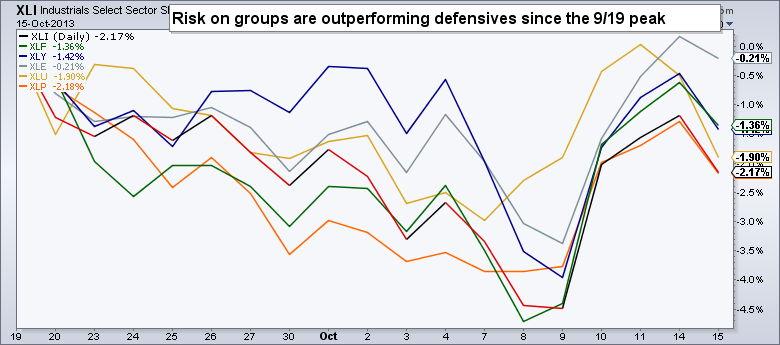

Sector Rotation: Energy leading generally signals we are near the end of the traditional business cycle.

Bullish Counter: We are seeing relative weakness in defensive groups like Utilities and Consumer Staples. This reads as a bullish backdrop. The bears have no case to make here.

The VIX is breaking out: The resistance line connecting the Nov 2011 highs and the Nov 2012 highs has been cleared. We'll feel more confident in this b/o though if it sustains over 20.

Bullish Counter:

The IPO market is running hot: According to

Renaissance Capital, in the last month 36 IPO's have priced. Generally that is a warning of too much equity supply coming out. Everybody wants to go public now that stocks are making all time highs and 'the coast is clear'.

Bullish counter: this huge increase in IPO's is logical given the glut created over the last five years.

Wave structure: So I was about to post that the S&P 500 has currently stopped at the .786 retrace of the move from the September 19th high at 172.76 and the October 9th low of 164.53.

Those who have studied wave theory know the .786 retrace is famous for ending second waves where late bulls and bears are often trapped.

HOWEVER, the 78 retrace just got blown out of the water. We can't say this is the start of some huge bear market, but it's not unreasonable to believe markets will re-test the October lows. Wave 2's and B waves have similar sentiment characteristics and the B wave is the best case scenario for bears.

So what do you think? What makes sense here and what doesn't? The bearish point that bothers me the most is the sentiment that these dips are late bulls golden opportunity to get in.

At the end of the day, these are all little more than talking points for individual traders and investors. If there is one thing this year's rally has proven, it's you must just manage your stocks when applicable. Why would that change in the seasonally strongest time of the year?