I just want to give a quick shout out to everybody who reads the site. Hopefully you and yours are well! After months of consistent posting, I went relatively dark sort of randomly. I'm still here and want to share an update of my month, if you care.

September was really rolling here as I had one of my best trading months ever and the content on this site and my StockTwits feed was very good as far as I could tell. Everything was going GREAT.

However, pretty early in October I just got completely burned out and hit a brick wall of exhaustion. I just needed some time to unplug and relax. So I planned some down time around Stocktoberfest.

Since then, some unforeseen circumstances have popped up and have really disrupted my focus. It's been a HUGE challenge to provide useful commentary, so I just haven't as I try to get my mind right.

Stocktoberfest

I decided to go to Stocktoberfest, an incredible fin tech / venture capital / markets conference held by the Howard Lindzon and the Social Leverage crew. If you want networking event where you learn a TON about the different aspects of the investing world that is basically a vacation - Stocktoberfest is for you.

The conference was held at the Hotel Del Coronado in Coronado, California. The Hotel Del is just incredible and is located on the ocean. It's hard to beat that combo.

The great thing about Stocktoberfest was getting to know some of the folks you chat with online, but have never met.

Brett Steenbarger stole the show with an amazing presentation debunking myth after myth about trading performance. That said, there was amazing discussion going on for two days straight.

Challenges

They say after a run of success it's only human nature to get conservative. I tried to fight that, but apparently did so poorly as it only manifested itself as greed. Maybe feeling the exhaustion was my way of being conservative, as I've pushed myself beyond the limit for quite some time now.

There is plenty to learn in this psychological aspect of trading. For whatever reason, it's rarely talked about.

After unplugging, I've found it extremely difficult to plug back in and find that high level of focus. From what I can surmise, it's a product of poor planning as well as not understanding the attitude and thought processes that put you in position for success.

Onward and Upward

That said, November is coming and a new month is upon us. I'm looking forward to getting back on the grind all winter with the NEW subscription only Rotation Report coming soon. All I ask is your email as I try to measure my audience. If interested, be sure to sign up on the right --->

Again, thanks for reading and all the great conversation! We're all in this together to get better. Let's have a great rest of the year!

October 29, 2015

An elite list of trading truths

I stumbled upon a post from Barry Ritholtz with a list of market truisms from Arthur Huprich.

First, a little background on Arthur. For years he was Raymond James Chief Market Technician and he currently serves in the same capacity at Day Hagan Asset Management.

This list is one of the best I've come across for technical traders and technicians alike. I've placed my favorite tips in bold.

• Portfolios heavy with underperforming stocks rarely outperform the stock market!

• There is nothing new on Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again, mostly due to human nature.

• Sell when you can, not when you have to.

• We can’t control the stock market. The very best we can do is to try to understand what the stock market is trying to tell us.

• Understanding mass psychology is just as important as understanding fundamentals and economics.

• Learn to take losses quickly, don’t expect to be right all the time, and learn from your mistakes.

• Don’t think you can consistently buy at the bottom or sell at the top. This can rarely be consistently done.

• When trading, remain objective. Don’t have a preconceived idea or prejudice. Said another way, “the great names in Trading all have the same trait: An ability to shift on a dime when the shifting time comes.”

• Any dead fish can go with the flow. Yet, it takes a strong fish to swim against the flow. In other words, what seems “hard” at the time is usually, over time, right.

• Even the best looking chart can fall apart for no apparent reason. Thus, never fall in love with a position but instead remain vigilant in managing risk and expectations. Use volume as a confirming guidepost.

• When trading, if a stock doesn’t perform as expected within a short time period, either close it out or tighten your stop-loss point.

• As long as a stock is acting right and the market is “in-gear,” don’t be in a hurry to take a profit on the whole positions. Scale out instead.

• Never let a profitable trade turn into a loss, and never let an initial trading position turn into a long-term one because it is at a loss.

• Don’t buy a stock simply because it has had a big decline from its high and is now a “better value;” wait for the market to recognize “value” first.

• Don’t average trading losses, meaning don’t put “good” money after “bad.” Adding to a losing position will lead to ruin. Ask the Nobel Laureates of Long-Term Capital Management.

• Human emotion is a big enemy of the average investor and trader. Be patient and unemotional. There are periods where traders don’t need to trade.

• Wishful thinking can be detrimental to your financial wealth.

• Don’t make investment or trading decisions based on tips. Tips are something you leave for good service.

• Where there is smoke, there is fire, or there is never just one cockroach: In other words, bad news is usually not a one-time event, more usually follows.

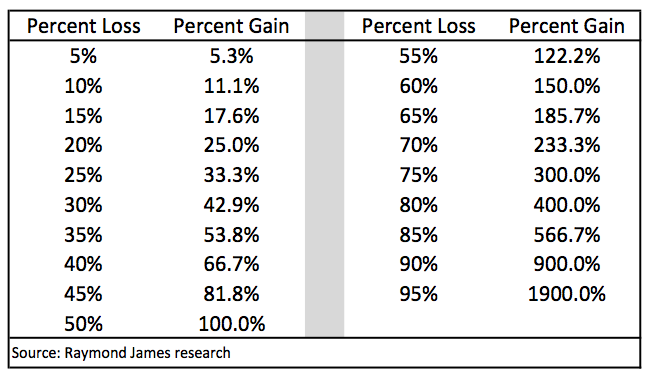

• Realize that a loss in the stock market is part of the investment process. The key is not letting it turn into a big one as this could devastate a portfolio.

• Said another way, “It’s not the ones that you sell that keep going up that matter. It’s the one that you don’t sell that keeps going down that does.”

The table below depicts the percentage gain necessary to get back even, after a certain percentage loss.

• Your odds of success improve when you buy stocks when the technical pattern confirms the fundamental opinion.

• As many participants have come to realize from 1999 to 2010, during which the S&P 500 has made no upside progress, you can lose money even in the “best companies” if your timing is wrong. Yet, if the technical pattern dictates, you can make money on a short-term basis even in stocks that have a “mixed” fundamental opinion.

• To the best of your ability, try to keep your priorities in line. Don’t let the “greed factor” that Wall Street can generate outweigh other just as important areas of your life. Balance the physical, mental, spiritual, relational, and financial needs of life.

• Technical analysis is a windsock, not a crystal ball. It is a skill that improves with experience and study. Always be a student, there is always someone smarter than you!

Trade 'em well!

Another Post Fed Rug Pull

Small caps have lagged the rally over the past couple of weeks. After the Fed announcement yesterday, it appeared they were finally set to breakout. However, today brought no follow through.

A quality short opportunity has formed in Russell 2000 ETF IWM. The gist of the trade is to be short versus the yellow shaded area. The most notable target area is 113.

Full Disclosure: I am short IWM via levered ETF TZA.

Trade 'em well!

A quality short opportunity has formed in Russell 2000 ETF IWM. The gist of the trade is to be short versus the yellow shaded area. The most notable target area is 113.

Full Disclosure: I am short IWM via levered ETF TZA.

Trade 'em well!

October 04, 2015

Key Technical Concept: RSI Failure Swing

The RSI failure swing is simply a more noteworthy version of a classic momentum divergence.

For those that don't know, a momentum divergence is when price makes a new relative high or low, but with less oomph. Generally speaking, the RSI failure swing tells us the smart money is getting out while the dumb money is piling in. What this suggests is a trend reversal (if just only short term) could come next.

Arthur Hill over at StockCharts.com noted this key technical development in the oil and gas sector. Here's a look at what he's seeing.

For those that don't know, a momentum divergence is when price makes a new relative high or low, but with less oomph. Generally speaking, the RSI failure swing tells us the smart money is getting out while the dumb money is piling in. What this suggests is a trend reversal (if just only short term) could come next.

As for the oil and gas space, a ton of low risk opportunities have developed of late. Investors and traders alike need to pay attention to this space. This is our best opportunity to get long since Mid-March.

Thanks for reading! Trade 'em well!

October 02, 2015

Post Wrap: One hell of a Friday

It's been awhile since I shared a recap of meaningful posts. Here is the best of the currently valid ideas, research and thoughts on the market.

Ideas:

Biotech Stocks are holding a key support in multiple charting disciplines

Why Fitness Tech is going to be bigger than most imagine over the next few years.

Some Second Level Thinking on Gold IE debunking bearish conventional wisdom.

Why Gold miners are an awesome buy for investors

Research:

A whoa bottom signal in the stock market

Why we should get long stocks via crowdsourced intel

Some reasons for investors to still not be bullish

Market Operator thoughts:

The Greatest Risks

When trading stock market patterns, context is crucial

What Jim Harbaugh can teach us about mastery in trading.

On a side note, the site just had it's best month ever. THANK YOU ALL for reading and sharing! Let's have a great Q4!

Ideas:

Biotech Stocks are holding a key support in multiple charting disciplines

Why Fitness Tech is going to be bigger than most imagine over the next few years.

Some Second Level Thinking on Gold IE debunking bearish conventional wisdom.

Why Gold miners are an awesome buy for investors

Research:

A whoa bottom signal in the stock market

Why we should get long stocks via crowdsourced intel

Some reasons for investors to still not be bullish

Market Operator thoughts:

The Greatest Risks

When trading stock market patterns, context is crucial

What Jim Harbaugh can teach us about mastery in trading.

On a side note, the site just had it's best month ever. THANK YOU ALL for reading and sharing! Let's have a great Q4!

October 01, 2015

Hanging in the clouds

Biotech stocks are trying like hell to stop the downside momentum at a very critical level.

One of the less popular forms of charting is Ichimoku Clouds. I've lightly watched them over the past few years and noticed the very bottom boundary line seems to provide support in major uptrends. They have some crazy name for that bottom boundary. Maybe it's Tenken something or other.

Anyways the key point is, multiple charting disciplines are suggesting we're at a major support zone in Biotech ETFs IBB and XBI. I wouldn't be surprised if we get another bounce here. We can't judge the strength of any potential bounce based on this info, but we have an excellent area to trade against as our RISK.

Some Light Reading on Cloud charting

One of the less popular forms of charting is Ichimoku Clouds. I've lightly watched them over the past few years and noticed the very bottom boundary line seems to provide support in major uptrends. They have some crazy name for that bottom boundary. Maybe it's Tenken something or other.

Anyways the key point is, multiple charting disciplines are suggesting we're at a major support zone in Biotech ETFs IBB and XBI. I wouldn't be surprised if we get another bounce here. We can't judge the strength of any potential bounce based on this info, but we have an excellent area to trade against as our RISK.

Some Light Reading on Cloud charting

Thanks for reading! Trade 'em well!

Subscribe to:

Posts (Atom)

Reminder:

All ideas shown on this blog represent the authors opinion based on the data available.