Gulf States - Basically a middle east ETF. for more details click here

Gasoline - a small bull H&S has broken out as it makes a run at key trendlines above.

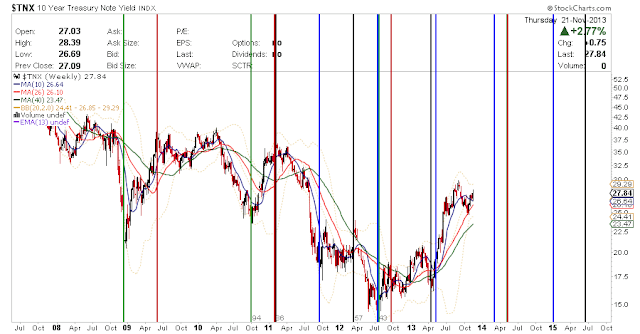

CRB Index - regained a key support line. This adds a lot of significance to the line. Taper signaling a decent inflation rate ahead??

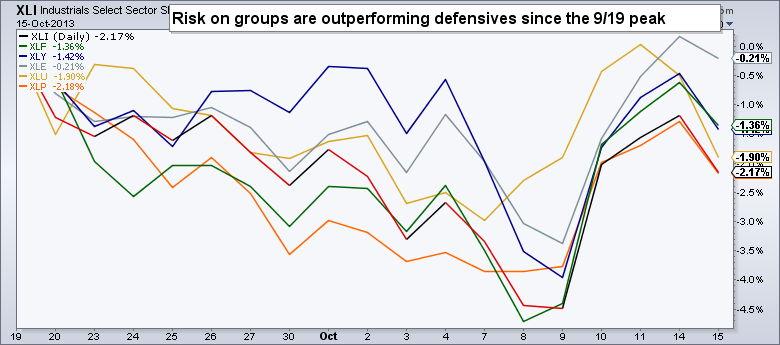

Groups to watch

GEX - alternative energy with a spectacular consolidation. This includes solars and things like CREE, TSLA

XNG - nice push past resistance. An explosive look. here's a link to the components

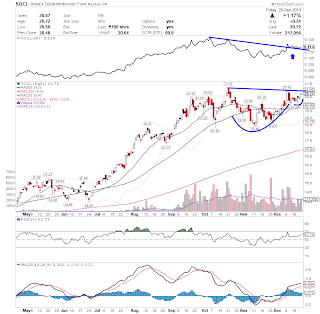

SOCL - a great cup with handle look while relative strength has already broken out

Fresh setups, hot breakouts

HBIO - a small biotech breaking a MASSIVE base A double> triple+ over time? My favorite fresh breakout out there and it's not close.

HIL - theres a great swing long opportunity here

EGAN - a winning net stock in 2013 has dipped under the 200D. A strong move over has our interest versus channel lows

SFY- breakout re-test

CLFD - Networking is picking it up in a big way of late. No sellers in this stock all year. A top pick here

MLNX - appears to be turning the corner exiting this long term falling wedge.

INSM - a key bounce at support this week. This all coming at a major breakout point.