The financials have really proven themselves over the last ten trading days or so. Let's start with the clear leader of the group JP Morgan.

Remember how America completely trolled #askjpm for two days last week? Well the folks at JP are getting the last laugh, and they'll be laughing for awhile.

There was a 6 month head and shoulders top in place, that has failed to materialize to the downside. Last week JPM broke resistance and has already cleared to new 52 week highs. This is clearly THE leader of the group.

Now lets look at XLF itself.

This has had just a stellar smooth uptrend (price on bottom) and during the recent 4 month consolidation, it never tested long term support.

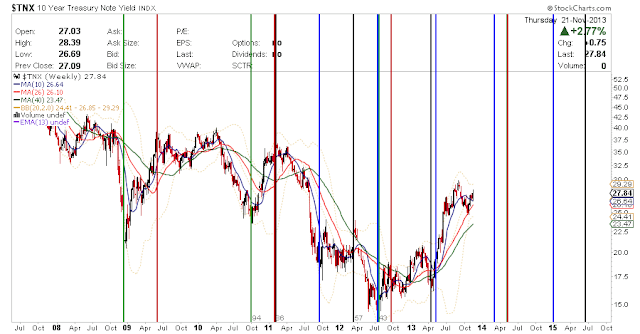

The most important chart out there is the 10 year treasury yield. We can all see that clear as day topping pattern. Check out the second chart that really shows the significance of these levels.

If yields can break above these key levels then all sorts of regional banks, savings and loans and investment managers will quickly become momo stocks. Some quality names of note include: TROW, FNGN, DHIL, BKCC, RJF, BOFI.

I'm a big fan of the stick with what you know methodology. Maybe that small bank in your town is a publicly traded and just maybe it's ready to rip 30-70%. It's definitely worth finding out right now as there are huge gains to be had still across the board.