Yellen's on deck Wednesday as the Fed lays out their economic projections. Sentiment around the Fed is so bifurcated. There are brilliant market minds convinced the Fed won't back down from their easy money stance and other brilliant minds sure that the writing is on the wall for a rate hike. Yellen is studied enough to know they need to raise rates while they can..Draghi and Abe on the other hand....

Be sure to check out my favorite reads of the week over at See It Market (will add link when it's posted)

MACRO

We could argue resistance is strengthening in the S&P 500 while the ease of movement index starts to move lower. The 4 month support line will tell us plenty near term.

Breadth is still disgusting, even in the S&P 500.

Stock Groups

XLE's Advance/Decline line has hit new lows. Price is masking the underlying damage.

Biotech continues in this tight range. It looks like a rollover setup to me.

It's worth repeating that Utilities have broken this long term trend

Cyber Security flashed major relative strength on Friday. What a beautiful group.

Other Markets

Numerous global indices and have been under substantial pressure in Q2. GAF has broken a two year support line

Also India is breaking a 9 month 12% head and shoulders top

This global weakness comes after massive flows have piled into international ETFs via @RyanDetrick

Smarter men than I are looking into the Yen: I want to piggyback here soon.

@hertcapital points out a potential massive shakeout.

Yen remains in a key LT price range. A shake-out below sets up a major mean reversion rally. $FXY pic.twitter.com/LaQmo6LI19

— Sheldon McIntyre (@hertcapital) May 28, 2015

@kimblecharting notes the key resistance level in the dollar / yen pairThe 10 year US treasury yield tested long term resistance this week. How long does this pull-in last?

Is that a golden cross in the 30 year treasury yield? Fade 'em.

Base Metals are trying to base out (ha)

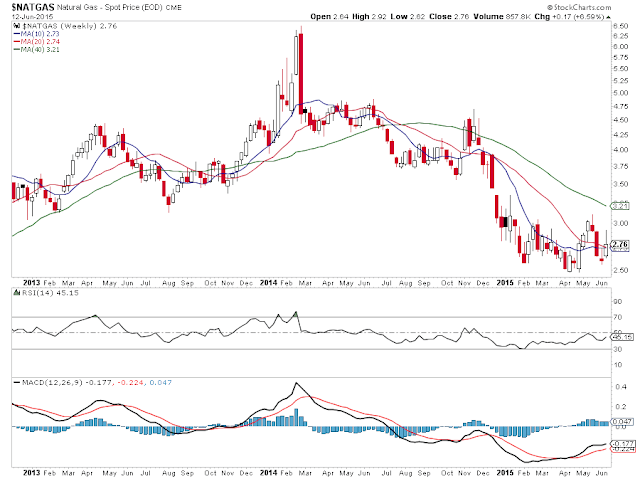

Nat Gas is also still working on a bottoming base

Other commentary:

Mike Shedlock wrote a provocative piece on Greece this week. Frankly, it doesn't matter if Greece gets kicked out of the eurozone, defaults or whatever. What matters is they're challenging the status quo of an antiquated system. When all the cards are on the table, they know they have less to lose than the IMF. It'd be quite easy for this rationale to catch on across the globe, given there are so many highly indebted parties everywhere.

How do we tie that into a trade is sure as hell NOT the right question to ask. However, that short the S&P 500 versus the good ole' 2007-2009 fibonacci extension level around 2140 is still in play with this whole mess unfolding and the market looking for a downside catalyst.

RE: Dick C stepping down as Twitter CEO - It's almost like the market wants to see more of an 'emptying of the cupboard'. It's worth noting the 'old boys network' is still in affect since Costello is still on the board of directors. Kick all of the Gilfoyle and Erlich Bachman types to the curb and Twitter shares could get back on track fast.

Trade 'em well!

No comments:

Post a Comment