This first chart is the daily put call ratio (CPC). I want to point out this week's action. Monday's CPC was in line with other levels where the optimism needed to cool down. Instead of just cooling down, today CPC swung to the other side of the fence! This change in sentiment is kind of amazing since the Dow closed green today. The crowd is volatile, and knee-jerk bearish.

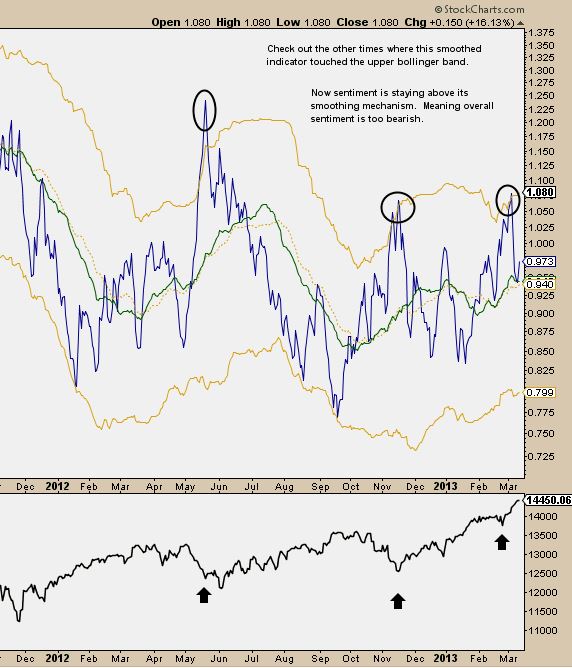

This next chart is a look at 2 moving averages of CPC(short term in blue, long term green). In our last post, we noted how upper Bollinger Band touches by the fast MA was an intermediate term buy signal.

Currently, the fast MA has stayed above the slow (and rising) MA. That tells us that overall sentiment is still quite bearish and essentially confirms the bullish signals we are seeing from CPC.

So what does all this tell us? We can relatively safely assume these bears are under-invested. Remember the market's #1 rule. It will always disappoint most people....and most people seem to be betting against the rally here.

We may also infer that a strong rally over the next few days/weeks could turn the sentiment tide too bullish.

I want to add that I have an SPX target range of 1590-1620 and a 99 target on IWM. If/when we move there and reach SPX all time highs, a psychological turning point may be at hand.

Have any comments or disagree with something you see? Feel free to ping me @aro618 on twitter/stocktwits. I'd love to discuss this further.

**Update 3/14/13** we are getting close to a very bearish reading in these indicators. This changed REAL fast.

2 comments:

good stuff aaron. thanks. amazing the persistence of negativity in light of the rally.

Thanks Phil! It's nice to know somebody reads this! lol

Post a Comment