The OPEC decision was huge, and there are a lot of FAST moving parts in the markets off of this news. Looking at the upcoming week, there are a lot more things that can go wrong than can go right at the moment.

Black Friday sales could disappoint, as so many retailers have stretched out their promotional periods. There could be unforeseen reverberations from the oil drop. Also we have both ISM reports(any energy related slowdown?) and the jobs report is Friday. With that, let's dig in!

The stock only NYSE advance-decline line hit it's flat upper bollinger band. The market is running pretty hot short term.

The ratio of high yield to investment grade corporate bonds continues to act poorly. Is there some bad news coming from the highly levered energy space?

The home builders ETF has reached MAJOR price and relative strength resistance

If you want a better read on the retail action post Black Friday, check out my See It Market post on Amazon The stock is at a critical level, and the near term direction may give us a hint about the group.

The 30 year treasury yield has started a new push lower. It'll be interesting to see how it acts in that October panic area.

The S&P dividend index relative to the S&P 500 continues to test an 80 week downtrend. Is the yield chase coming back?

Nobody is talking about it because of oil, but doctor copper has pneumonia as it broke down to fresh 2014 lows.

Now to the big story of the week, energy...

The rail index wiped out the last two weeks of gains this week. No doubt rails have been a huge beneficiary of the shale boom.

The oil producers ETF pooped the bed after testing the falling 50 day MA. Newer trader's might want to study this textbook action. The fresh MACD downside cross suggests there is ample room for downside. Here's a breakdown of drilling costs of various shale projects across the world.

Is the Bakken boom over? It makes for a great headline, but the world isn't binary. What we do know is Continental Resources relative to the oil producers group has cleanly broken the uptrend from the 2009 low. That's ugly!

With this huge energy sell-off, Halliburton is now testing trend support connecting the 2009 and 2011 lows.

It's easy to want to buy energy stocks here, but I look at something like an Apache (APA) and it couldn't even rally while XOP ripped for years with oil much higher. This likely has much more downside coming.

Airlines appeared to be rolling over, but were bought back up immediately as earnings estimates crank up with lower oil and fuel prices.

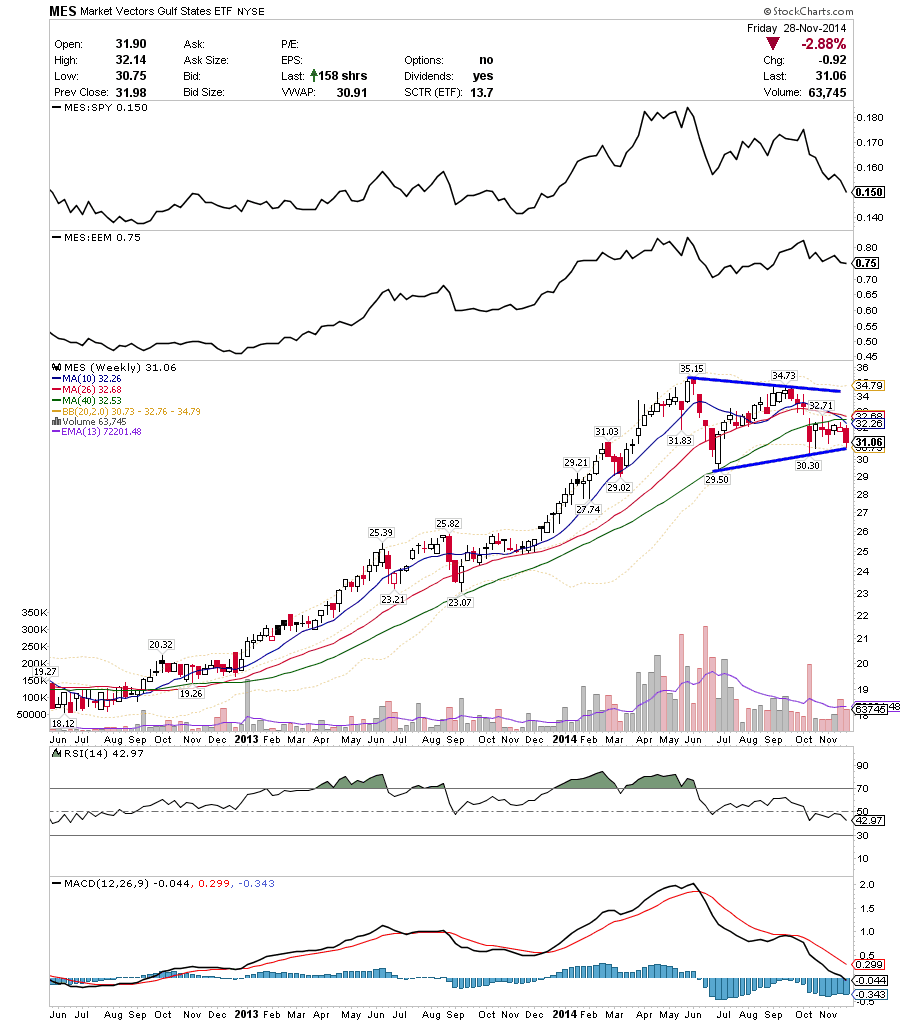

OPEC is apparently more concerned about making a statement to than they are their own good. The gulf states ETF, comprised largely of middle eastern oil producing countries, is sitting precariously at key support.

Moving outside of the US...

Germany had a very strong week after breaking resistance from the summer highs.

Emerging markets acted quite poorly after early week strength. How do they act with all these MA's nearby?

The all world index is finally testing the September highs.

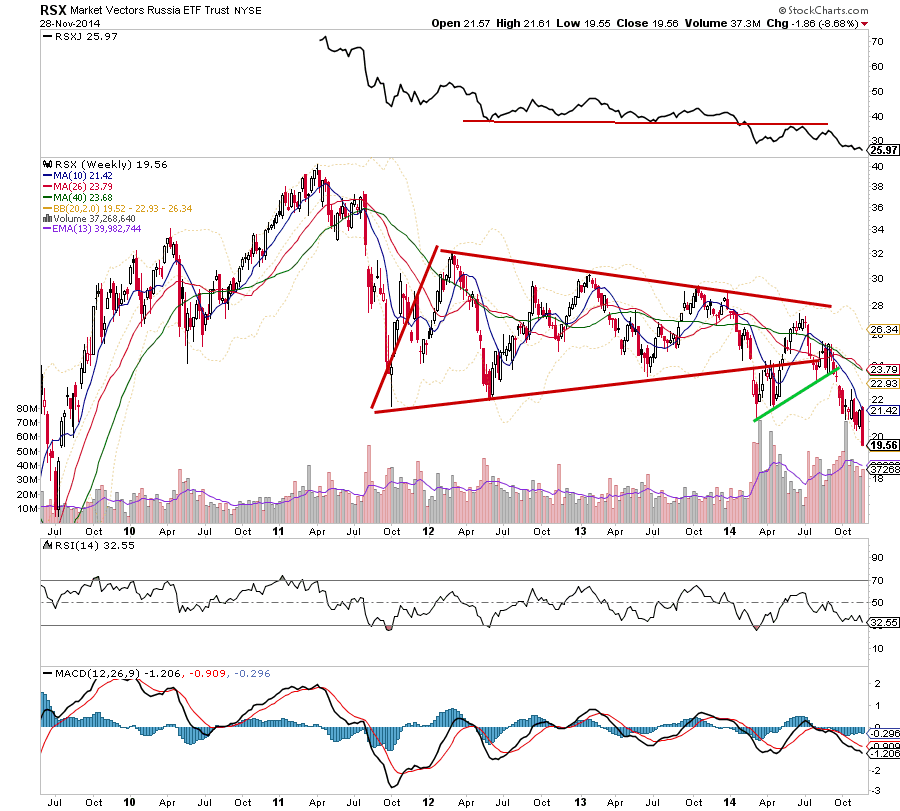

Apparently Russia sent some warships into the English Channel. Who knows what to make of it, but their market is really struggling and the defense industry continues to trade well.

Trade 'em well!

No comments:

Post a Comment