- Dividend names look attractive for long opportunities here.

- Sentiment and breadth suggest this recent bounce is for real.

- The mortgage finance group looks pretty good.

The dividend sell-off may be coming to an end here as rates are still historically low. Why? Check out these charts.

Real Estate Index - posting a weekly doji on heavy volume

The Soft Drink Index with a piercing line candle reversal with relative strength in a long time support zone.

Consumer Staples relative strength is bouncing off a significant support line.

Pipeline Index with an in neck candle reversal in a long term relative strength support zone.

Finally, and most importantly, the 10 year yield is reaching significant resistance.

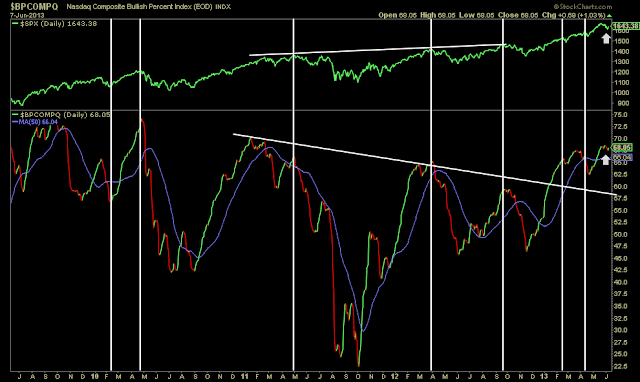

Breadth is looking healthy at this point and flashing buy signals.

Note how the Nasdaq bull % index has held up extremely well during this most recent sell-off. The horizontal white lines show other pull in's off SPX peaks.

NYMO gave a strong bounce signal Wednesday night. There is still more room to go here.

This recent spike in this volatility ratio leads me to believe we can at least re-test the SPX highs.

CPC is showing more bearish sentiment than the November lows. That's pretty bullish if you ask me.

Our ATM options sentiment indicator is oh-so-close to firing a buy signal. This last fired off at the lows in early March and at the market bottom in November.

XOP has a cup and handle look to it. Notice the strong bounce before it even touched the 50D. A clean setup on one of our top five groups.

No comments:

Post a Comment