Outside of the US, India has maintained it's position as the leading emerging market and now Brazil is trading brilliantly coming off major post election lows. A nudge higher in the Shanghai Composite and the Asian markets are off to the races in unison.

The race to the currency bottom outside the US is accelerating. Dollar strength is becoming a huge theme and at this point there seems to be no end in sight. It'll be interesting to see how it plays out.

Let's dig in

Vol term structure is already in the toppy zone, but could still work lower. Incredible.

Industrials had a false RS breakdown. Now price has broken resistance from the summer. What a nice bullish turn of events.

The home construction index is at meaningful price resistance. RS really tailed off last week.

Looking at the PNF Bullish Percent indices, we see much broader health in the defensive groups. Also note the weakness in Consumer Discretionary. Energy is still VERY oversold.

The stock only A/D line is nowhere near the highs, but the NYSE composite isn't either. It's a ferocious push higher.

One possible scenario that may actually be happening now is the yield chase accelerates after rates bottom and while raising rates plays start working. We're seeing some signs of life from the regional banks/insurers S&L's etc. But interestingly, Utilities, Consumer Staples and REITS are very strong.

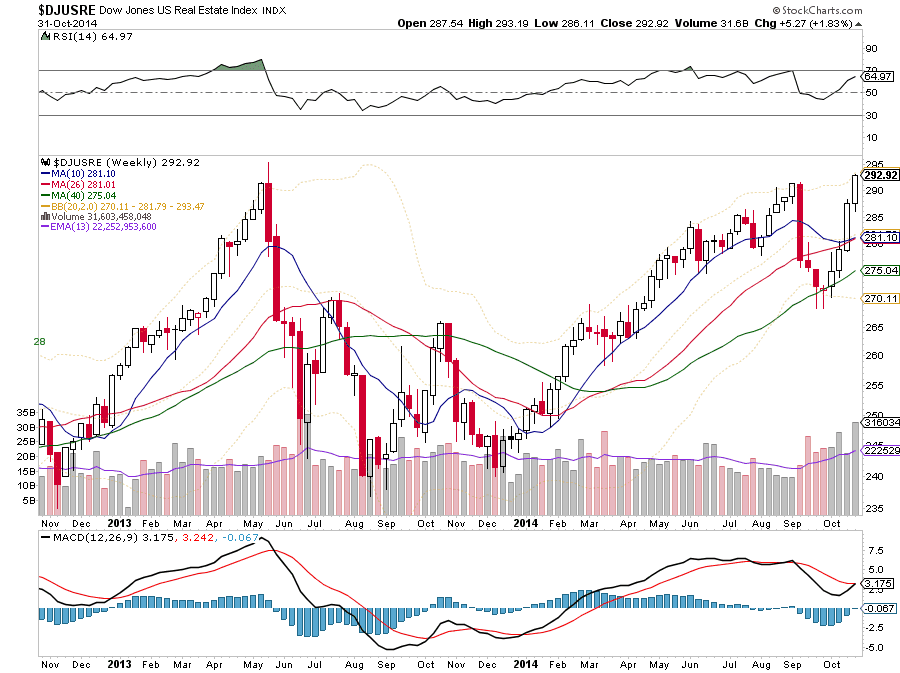

Real Estate RS is testing the pivot. Are folks still looking for yield? Are rents going up?

This occurring while the Real Estate Index is testing all time highs.

Regional banks relative to financials are breaking out of a falling wedge. Is this a sign of loan growth or rate growth?

The Regional Bank index is breaking out of a large wedge and also breaking out relative to the S&P 500. Great signs for the group across the board.

Financials had a major engulfing month in October after touching the trendline connecting 2009 and 2011 lows.

While commodities were sold indiscriminately after the Fed announcement, base metals had a strong week after some basing at the 40 week MA. What a bullish sign for growth and the economy.

The CRB also hammered Friday attempting to make a higher low.

Oil services is pushing to break this first resistance level. Above it, there is plenty of room for oversold conditions to be worked off.

No comments:

Post a Comment