All sorts of my sell signals went off last week(as referred to here mid-post). As the market continued to ignore them, I essentially said the hell with it and decided I would focus posts on riding the white lightning until the blow was gone and we all had coke hangovers.

Today we may have gotten the signal that the coke is gone. It's signified by major price reversals in the indices.

Looking at the S&P 100 and 500 breadth data we can see these are completely pegged to the upside. Something has to give here, right?

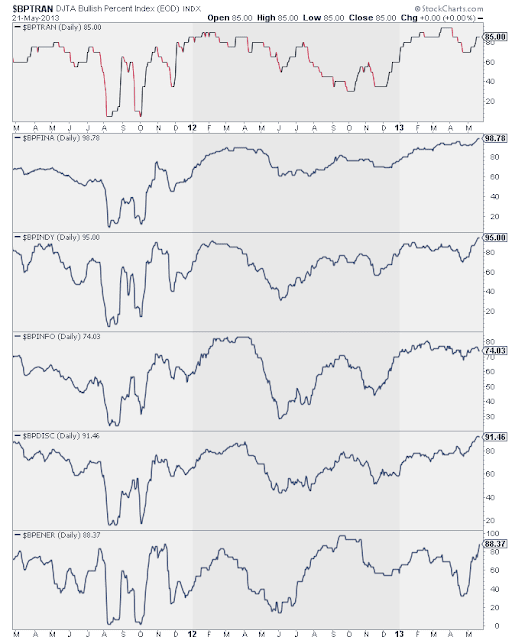

Here are the bull % indices of offensive sectors. indy = industrials; info = tech ; disc = consumer discretionary; fina = financials; ener = energy. We can see again these are either pegged to the upside OR are diverging from price (shown in transports and tech) as their groups make new highs. Neither are bullish signs, but keep in mind people have been making arguments about these bull percent indices since March.

Finally, a contrary point of view shown by the up down volume ratio. When the ratio was at this level or lower during this rally; a varying bounces have followed. I don't really know one way or another, but thought it's worth pointing out.

To summarize, we need to take today's market action seriously as it's the most significant price warning signal thus far in 2013. I'll be watching our bullish ideas to see if they can hold up, but we just don't know what's coming next.

Twitter @a_jackson8 Stocktwits @a_jackson

No comments:

Post a Comment