This is the start of earnings madness. There are about 70 reports I'll be looking into on this shortened week.

If you're inexperienced, it can be brutal trying to swing trade because of all the moving pieces. The odds are very good that a swing trader gets caught up in a false swing that flips the other way 2-5 days after the earnings move.

With that, let's dig in

Quick summary:

- Signs of caution continue to build into earnings. An intra-earnings season sell-off isn't unusual and I expect one this quarter.

- Groups like software, drugs and construction continue to lead.

- Setups are more scarce, but there are plenty of short term bounce plays

- Group bifurcation is increasing. The consumer might just be dead with the way the group is trading!

Reviewing last week's preview:

After a pullback early in the week TLT reached new highs and still looks fantastic as it approaching the October high and declining 200D SMA.

GDX had a fantastic broke the relative strength H&S bottom and poked over the key resistance line. The group still looks good over the short term.

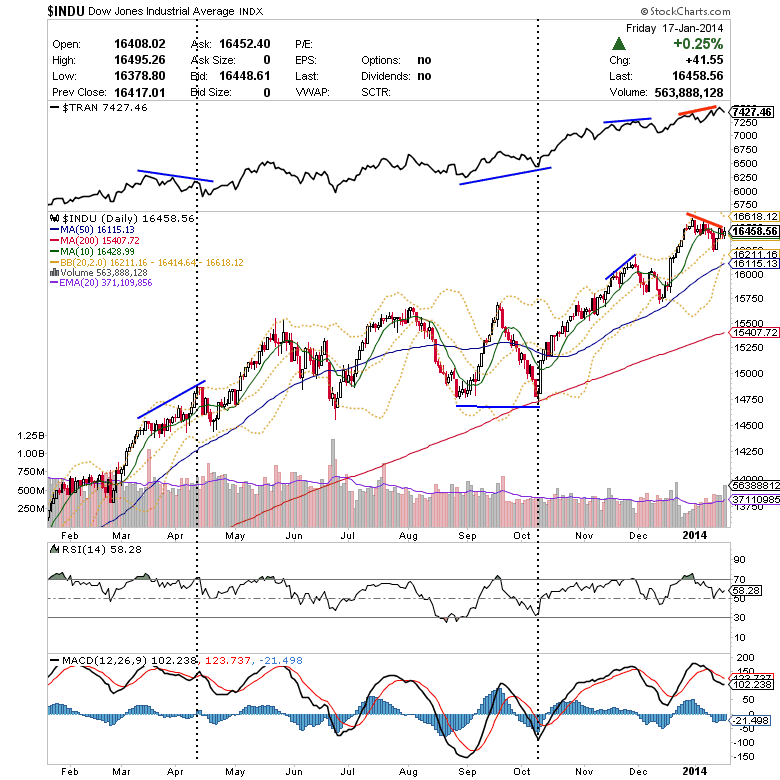

The Dow Transports high still hasn't been confirmed by the Industrials. This becomes a bigger issue as time passes, but it's tough to be that concerned yet.

I entered VIMC, mentioned last week, on Thursday and added Friday AM. This thing has rocked and has serious potential still. Unfortunately there isn't an attractive setup for fresh longs here and now.

SLCA broke down from it's pattern and, with a lethargic move back to the breakdown area, it's a short candidate at this point.

Broad Market

A bunch of SPY peak and low cycles are lining up around this week. Any outsized moves may give us a hint to the future direction of the market.

Volatility is getting real low. So low it's a bad thing IMO. Note the trendlines are converging.

% of S&P 500 stocks over the 200D are approaching critical support lines. A loss of the more gradual line B is a signal to reduce longs in a meaningful way.

Base metals continue to coil under resistance. Big gains could be ahead in the group

Gold + miners story could really accelerate if the orange + blue resistance confluence are both taken out.

Gold + miners story could really accelerate if the orange + blue resistance confluence are both taken out. EEM was rejected by the 200D. The 39.25- 40.50 range is critical.

The Nikkei dojied off the 10 wk MA and the weekly MACD is still positive and approaching a test from above.

The Aussie Dollar is breaking down invalidating the large double bottom pattern. Momentum isn't confirming, but this is worth watching in the commodities space.

Stock/Group trade ideas

Specialty Retail has had a sharp break down. Looking for a bounce around the 40 week moving ave. 1% lower.

Let's watch housing (ITB) into the 10 wk SMA. Recent IPO LGIH has been largely unaffected during this recent pause and ripped hard last week.

XHB price is at a 3 month support line. Will it hold? If it breaks, I want to have short exposure to LOW via Feb options.

Restaurants appear to be following retail lower. Nasty chart of late

Semiconductors have reached heavy price and relative strength resistance from the mid 2000's. It's smart to stay away from fresh longs in the group for now.

Strong groups that must continue leading: Shippers, Software, Drugs, Fertilizers, Construction

Large banks sold off hard post earnings. For example: C. Watch the strength of the bounce at the 50D.

It's amazing how strong Amazon has held up with the retail weakness. Clearly people did the online shopping thing this holiday season. It wouldn't surprise me a bit if it skyrocketed on earnings. I want long exposure leading into the report.

I'm watching EXTR as it pulls into it's previous base. There's a heck of a catalyst here as they have the in-stadium Wi-Fi at the SuperBowl.

No comments:

Post a Comment