As we're seeing one of the best earnings seasons in recent memory, meaningful divergences are showing up in market breadth. This is going to a problem for the market at some point in the near future.

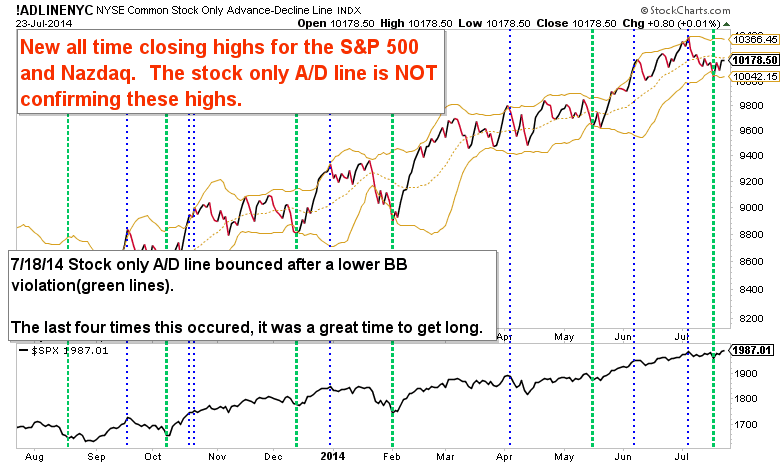

We see the NYSE stock only advance-decline line is barely bouncing after the major breadth sell-off of the past couple of weeks.

The highly concentrated Nasdaq ETF QQQ has reached new price highs while the Nasdaq Composite has not. We can also see the major divergence in the A-D line.

Let's not forget the major divergence in high yield corporate bonds.

Also every measure of risk in the bond market has been flashing caution for awhile now, but it just hasn't mattered.

The example I've shared time and again on stocktwits and twitter: the high yield to investment grade corporate bond ratio is breaking down below the largest top in the history of these ETF's.

These divergences are definitely warning signs, but we can't act like the markets will immediately acknowledge this. They haven't.

It feels impossible that these divergences are setting up with all our favorite large cap stocks crushing earnings and trading higher, but that's what the market does.

It's smart to be skeptical of the rally, but there is no logical option but to wait for an evident reversal to take a shot short. Who knows when that'll be, but it feels like it may not be too far off. Until then, we can ride the large cap fund faves on the long side.

No comments:

Post a Comment