Some ETFs can provide valuable information about how various market groups are trading. Digging through the holdings and structures can provide us with plenty of information. Let's take a look at the IPO ETF for example. I thought 'hey this would be a great proxy or tell for the recent IPO space'. Sadly, that's not the case.

Here are top holdings of the IPO ETF.

It's highly weighted in higher market capitalization names like Twitter and Alibaba, which are trading poorly.

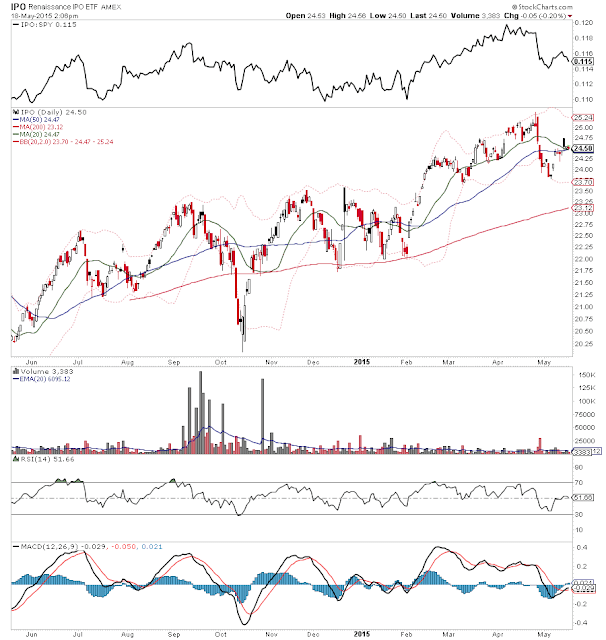

Here's a look at IPO's chart

The price action in the ETF is misleading and is not indicative of the trading opportunity or price action in the group. Things like FRPT, SHAK, AMBA, DATA, JD, MBLY, ADPT are just smothered by the weighting system.

Was IPO was just constructed to be a just another motif for advisers to pitch? Maybe, I doubt it, but who knows. The fund's construction methodology is just not conducive for us to measure the true activity of recently IPO'd stocks

Full disclosure: i'm long DATA and SHAK

Trade 'em well!

No comments:

Post a Comment