With each new low in the Dow Transports there are a handful of new commentators explaining why they don't matter. Think about it. Remember the countless bullish occurrences in the market over the last 5 years? Where scores of market commentators lined up to tell you excuses why they didn't matter (ie the Fed's ruined everything). That doesn't mean they'll be wrong soon though.

@millenial_inv ponders, is it now smart to be stupid? It might just be the next few months. We look at the various divergences in breadth, Dow Theory and some recession-esque economic data and they're all warnings signs that can lead the market for quite some time.

The issue with thinking things can continue like this for some time, is the 1.618 fib extension level from the 2007-2009 range (the 2138 S&P 500 level) I continuously mention.. If you're a Fibonaccian - this is pretty close to ''an ultimate test'. A Golden Ratio extension coming off the most important range of the last generation in the world's most renowned stock index. You'd think we could at least get a pullback with deteriorating breadth and fundamentals.

If this 2140 area in the S&P 500 is taken out, we're going to add a few more plays to the chaser's playbook.

It's worth repeating that regardless of the broad market, short term traders with a focus on the upside are making the most money. Barring a massive market event, odds are that can continue in June.

Anyways, back to the charts...

Fear is at the top of the recent range. This suggests we've seen no shift in environment even though the bulls have lost the baton short term.

Groups

Point blank, it sucks to be missing the semi trade. The leaders in mobile computing, data center and the internet of everything have done an incredible job separating themselves from the group this year with massive gains off the October lows..

It's so hard to short single stocks. M&A risk continues at a multi year high. The financing for deals is there and more importantly growth, like in the semi space, is becoming increasingly scarce.

Now large buyouts have the space at 52 week highs. Interestingly, SOX relative strength has lagged recent highs.

Biotech has stalled like the rest of the market. It'll be interesting to see what comes after the big cancer conference which ends Tuesday.

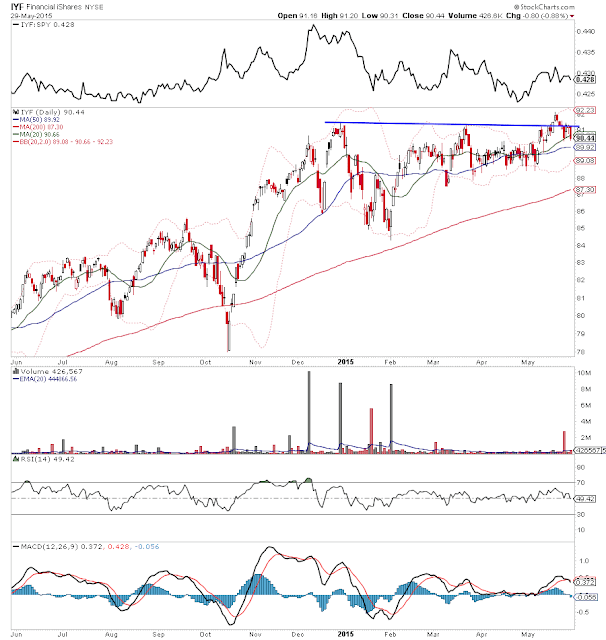

Financials are at the heart of the 'I don't know why i'm bullish, but buy 'em cause the fed' epidemic. Is this multi year laggard going to buck up and lead? Or is this a false breakout? This could be the opportunity of the year to short financials, with limited risk.

Oh by the way, the TED spread is rising every day and at 2 and a half year highs.

Tourism has pretty much confirmed a false breakout. The group's US components have acted poorly of late. Note the recent exhaustion gap in EXPE (not shown).

Selling continues at the 50 day moving average in the retail ETF. BTW, anybody been to the mall lately? There are more 20-30% off sales everywhere.

Other Markets

Just when you thought Nat Gas might hold a rally... where will it stop and base? This could be part of a larger bottoming process.

High yield bonds continue to hold a bid.

Note when Hong Kong joined the latest Shanghai rally it really marked the top in China.

The Philippines continues to be one the world's best markets as it approaches a potential buy zone.

Can the S&P 500 break away from it's 2015 downtrend relative to the rest of the world? That'll be a key with the damage picking up in China, other emerging markets and Europe.

Trade 'em well!

No comments:

Post a Comment