Remember Amazon's monster earnings pop lasted 10-15 minutes in the open market before fading? This week, LinkedIn and Twitter's earnings pops lasted all of ten minutes in after hours trading. Absurd moves are happening and smart money is cashing in immediately.

There are plenty of data and opinions out there that support nit picking bearish arguments. The main problem with that is the most important argument of all is PRICE. The major fibonacci extension levels in the S&P 500 and the Dow Industrials continue to cap the markets. That continues to tell us there is limited upside on a broad market basis. If those levels break, we can adjust our point of view, but not until then.

Let's hit the charts..

Once again, just like that the market is fearless.

Breadth is starting to come back in the S&P 500. Note the ratio didn't form a fresh low with the market.

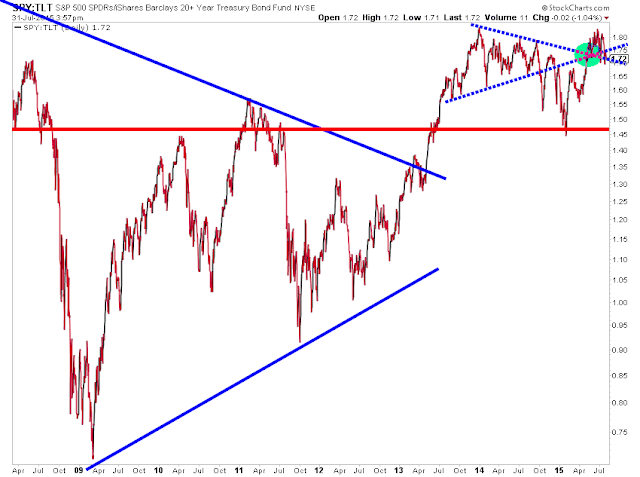

The stock vs bond ratio broke a multi month range lower. Looks like we can expect bonds to out-perform near term.

Group Action

I've pointed out the action in semi's during the week. Note the MACD bull cross. I'm looking to buy weakness early next week for a larger oversold bounce to test the 200 day moving average. This would be a much higher probability opportunity if the market wasn't so 'fearless'.

The 51.75 area looks pretty solid. Also note the daily Bollinger Band support at 51.

Energy tried to reclaim the winter lows and failed. This group is awful and even worse if it holds new lows.

Utilities are trying to break clear of resistance. They'll likely be tied to bonds in the near future.

Can steel bottom out here at the spring lows?

Gold miners are coiling up here. The left for dead group is showing signs of potential.

7-10 year treasuries have broken out of head and shoulders bottom. That said, there is still some resistance to work through

Trade 'em well!

No comments:

Post a Comment