The action in the mega cap leaders has just been absurd of late. For example, take Amazon. It was already significantly overbought on a weekly time-frame leading into earnings and it just happened to gap up 100 dollars and open 15% above the weekly upper bollinger band (the most since 1999). You don't see this action all the time. It's late stage bull market stuff. But how late?

Chris Kimble notes the recent high in the Dow Industrials is also the 161.8 fibonacci extension from the 2007-2009 range. That index joins the S&P 500 with the same extension level peak. These markets are in really in sync.

Heading into next week we have two scenarios setting up. Scenario A, we bounce soon around this market wide pivot zone. Scenario B, the market completely shits the bed. Let's figure out which is more likely.

The

S&P 500 weekly chart looks like a disaster with a bearish engulfing week. I think that's just a timing matter that just scares people this weekend.

But then we look at the daily chart and there is plenty for bulls to work with if they want to buy come Monday or even on further weakness.

Market Measure

Of course breadth is 'scary' divergent.

Dana Lyons did a great job

explaining how breadth has massively deteriorated of late.

Looking at the

NYSE breadth dashboard, it's leading the market to new lows.

Everything market measure wise is getting scary, The difference between now and a month ago is there is no 'in your face situation' like a Greece that's soon to be resolved. This action is just coming from weak market internals and poor commentary from corporations.

Even with all this concerning action, there's not much fear in the market per

vol term structure.

The VIX is only trading with a 13 handle.

This all suggests we should be careful. Especially with limited upside capped by the major Fibonacci extension levels in the Dow and S&P 500.

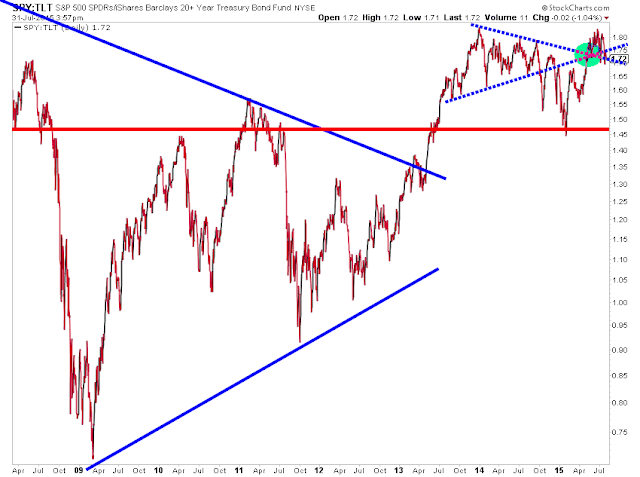

For a year I've harped on the major tops in bond market risk appetite. I've been wrong in thinking it's a coincidental indicator and forced fit it into views particularly last fall.. However, now we have a lower high breaking down that could weigh heavily on the market.

Group Action

Materials have exceeded the downside measured move as we've reached a pretty important bounce zone.

Last week, I

wrote on this massive head and shoulders top in Intel. Why does this matter? It's 19% of

semiconductor ETF SMH. Now it's broken down and has also lost trend support from 2012. That's a BIG top. It's naturally tempting to step into the group, but man this will be an anchor for the group for months.

Random question, why does this XLP chart look like the NASDAQ 100? Anyways it looks great if it can hold.

The

financials have struggled to break above the upper boundary line. The trend is still strongly higher, the group is also expected to have the second best EPS growth in 2H 2015. It'll be very interesting to watch this group moving forward.

Other Markets

Friday was the clearest bearish reversal candle we've seen in the Shanghai July rally. In my book, FXP is the best ETF way to short China. We could definitely see a test of the low area in the next week or two.

The

DAX has reached a moving average confluence. Even if that were to give way, there is a strong chance this is a bottoming base that's been building since May.

Emerging Markets via EEM is on verge of a major breakdown. That would be a MONSTER headwind for the market. I'm looking hard at ultra short emerging market ETFs.

Oil is approaching some new notable support levels.

While price in the major indices suggest support is near, the underlying action is suggesting there is a very real chance the market shits the bed, eventually. We've seen plenty of later stage bull market action across the board. Whether we bounce first and continue to loiter back near 2120 for awhile is anybodies guess. China could be a real drag on the market and we'll know if that bearish reversal candle confirms by the Monday open.

Trade 'em well!