It's still a sideways market, but the markets are showing a clear risk-on stature for the first time since ....?? Just speaking for the 600 or so stocks I follow, last week stocks traded as well as they have all year. However, if the broad indices break out, it wouldn't surprise me if many groups remain range-bound simply due to poor technical posture. Let's dig in.

Mid-week I wrote this anti-dollar trade post. That all went to hell in a hand basket Friday as the US dollar futures broke out of this falling channel. However, the Ag trades still are compelling.

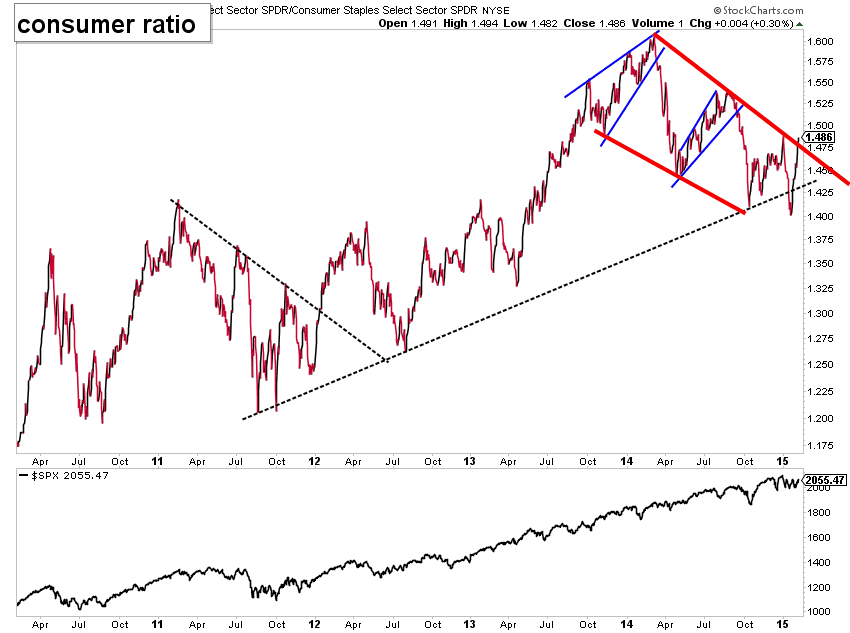

At the same time, the consumer ratio has ripped relentlessly after falsely breaking the trend from the 2011 lows.

It's worth noting the S&P 500 equal weight index has led the S&P 500 out of this range. It's also positive that the bollinger band has turned up

Advance Decline lines

The NYSE advance decline line has hit new highs. It'll be interesting to see how it's affected by the rate sensitive plays.

Looking at the stock only advance decline line, we see the upper band penetration suggests we may see some early week weakness. The last time the band formed a U or V was in November and the market only persisted.

So much for safety

Gold fell sharply on the excellent jobs report. It dropped to the rising 50D MA Friday. There's an interesting confluence in the next 1% down or so. Also, there's still the open measured move in the 1330's.

Gold RS lost the trendline breakout. Only time will tell if this forms a higher low or not.

It was an incredible roll-over in utilities as they lost the 50 day MA and quickly approach a pivot.

Meanwhile, Utes RS gave up the dual breakout. We'll have to watch this further develop in the coming days and weeks.

The corporate bond ratio has turned bullish in the short term. This is a complete wait and see mode in the longer term. The question is are credit conditions improving or

Group action

Thursday the Cyber Security ETF broke out of this wedge pattern and was stalled out by horizontal resistance near 26.50. Many names in the group report earnings this week, and ultimately that'll drive the price action here.

The defense group just looks great if it can stick up here.

Materials were left for dead, now they're a percent from all time highs.

Looking at Materials RS, they could really outperform over the next 3-6 months.

Airlines were a notable non-participant in the rally as oil ramped higher. Clearly, the 50D MA is important.

Biotech is still questionable at best. We could say that about healthcare in general too. After the insane run, it'd make this whole space just exhales for awhile.

Overseas, not much has changed, but the Chinese small caps as they've diverged significantly from the other China ETFs. That said this is a major support zone.

Thanks for reading. Trade 'em well!

No comments:

Post a Comment