Last week formed doji weeks across the major indices and in groups like biotech, financials (two weeks in a row), housing, retail, hotels, software. Needless to say, we're watching last week's ranges like hawks and it appears the upside momentum is gone (more on that shortly.)

Specialty Retail has been a strong leading group all year. Note how the weekly candles have gotten smaller and smaller. The upside momentum is gone. We're on pullback watch.

This same thing is occurring in broad market indices like the S&P 500.

This is occurring while volatility is showing a lot of complacency. It's a perfect recipe for raising cash from long side winners and shifting swing focus to the short side IMO.

Sector Spotlight: Transports

The Transports ETF is also showing that similar pattern of candles becoming increasingly smaller. Notably, this group failed to confirm the indice's fresh highs.

Airlines are looking interesting. It's a potential wedge or head and shoulders top. The lower support line around 245 will tell the tale.

The safety trade

Utilities relative strength is testing trend support. Short term out-performance by the utes seems likely here.

Also Gold is testing long term horizontal support.

Soft Drinks broke higher out of a multi month wedge. Will it stick? Does it signal something about rates headed back lower near term?

Commodities

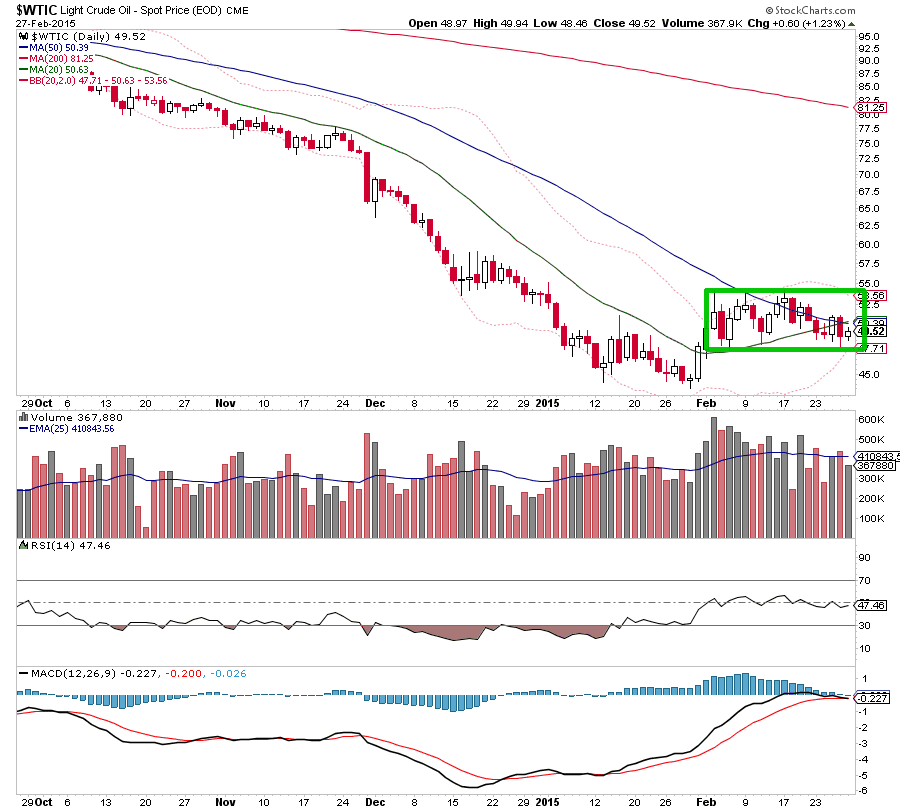

The crowd expects oil to fall hard. It's hard for anything to break down with sentiment like that. Especially when price is range-bound like it is now.

This while wheat and corn refused to break lower to end the week.

Thanks for reading!

No comments:

Post a Comment